Beyond the Potency Race: The Rise of Functional THC

How cannabis brands are shifting from maximum strength to measurable effects

2025-11-23 · 6 min read

Walk into most cannabis dispensaries, and you'll still see products marketed by their THC percentage-the higher, the better. But a quiet revolution is underway, driven by consumers who care more about how they want to feel than how high they can get.

The Problem with Potency

For years, THC percentage has been the cannabis industry's primary measure of value. Cultivators competed to produce the strongest strains. Retailers highlighted high-THC products. Consumers assumed more THC meant better quality.

But this potency-focused approach has created problems:

- Unreliable testing: Many watchdogs question the accuracy of THC testing

- Misleading metrics: THC percentage doesn't predict effects or quality

- Diminishing returns: Higher potency doesn't necessarily mean better experiences

- Barrier to entry: New consumers are intimidated by ultra-high-THC products

Cannabis advocates have long tried to educate consumers that THC percentage is an unreliable indicator of product quality or effects-with limited success. Until now.

Enter Functional THC

"Functional THC" represents a fundamental shift in how the industry thinks about cannabis products. Instead of maximizing potency, brands are designing products with precise cannabinoid ratios and measurable impacts tailored to specific activities or desired effects.

Think of it as moving from "how strong is this?" to "what will this do for me?"

What's Driving the Change

Several cultural and market forces are converging to make functional THC the industry's next frontier:

- Wellness culture: Consumers increasingly view cannabis as a wellness tool, not just recreation

- Microdosing popularity: Low-dose products allow for controlled, functional experiences

- Sober-curious generation: Younger consumers seek alternatives to alcohol with predictable effects

- Market maturation: As the industry evolves, consumers become more sophisticated

"Demand for effect-driven products has continued to rise," said Chris Emerson, CEO of LEVEL, a California edibles company that markets tablets for specific activities like gaming. "The market is moving away from generic 'this will relax you' marketing toward formulations that deliver distinct, repeatable experiences."

How Consumers Are Changing

Market data supports this shift. According to BDSA, cannabis beverages and low-dose edibles-products known for predictable onset and controllable effects-are among the fastest-growing categories at dispensaries.

This growth reflects a new consumer mindset. People want the same kind of dependable function they expect from their morning coffee or evening melatonin supplement.

"We see customers who won't buy anything else once they find a product that works," explained Dan Dolgin, co-founder of New York-based Eaton Botanicals. "They're not chasing potency, they're chasing reliability."

Shopping by Effect, Not Strain

This consumer evolution is visible on retail shelves. Alta NYC, a Manhattan dispensary, has reorganized its entire merchandising strategy around effects rather than strain names or THC levels.

Products are grouped into categories like:

- Rest: For sleep and deep relaxation

- Chill: For unwinding and stress relief

- Relief: For pain and discomfort

- Focus: For productivity and clarity

- Vibe: For social energy and connection

According to founder Vanessa Yee-Chan, "Vibe" drives the most traffic and repeat visits, while "Rest" and "Chill" products see the highest return-purchase rates.

"I found stores organized by brand or consumption method, but not by how you want to feel," Yee-Chan said. "At Alta, we wanted to make it simpler and more intentional."

The results speak for themselves: effect-based products outperform strain-based sales because customers value consistency.

How Brands Are Formulating for Function

Creating truly functional THC products requires a more sophisticated approach than simply adjusting THC levels.

The Science of Formulation

"Functional THC isn't a single molecule or a single dose," Emerson explained. "It's the correct THC dose, in a trusted matrix, for the intended moment."

LEVEL's development process combines:

- Empirical consumer feedback

- Peer-reviewed research

- Advanced machine learning

- Testing for onset, peak, and duration

The goal is creating repeatable, easy-to-titrate profiles that deliver consistent experiences.

Beyond Cannabinoids

Some brands are expanding beyond cannabis compounds entirely. Eaton Botanicals is developing low-dose gummies infused with adaptogens-plants and mushrooms associated with wellness effects-as well as other botanicals.

"We give them an effect, and they help us identify the right ingredients-but more importantly, the right doses," Dolgin said of the company's collaboration with functional-medicine partners at Indigo Wellness.

Each batch undergoes multiple rounds of testing-not just for compliance, but for taste, dosage integrity, and consumer feedback. Often, four or five variations are needed before finalizing a formula.

Education Is Essential

To sell functional products effectively, brands must educate both consumers and budtenders.

Eaton hosts budtender training sessions and farm visits to help retail staff connect ingredients to their intended effects. "Education is the most important thing we can do," Dolgin emphasized.

The Challenges Ahead

Despite growing momentum, functional THC faces significant obstacles.

The Research Gap

Limited scientific research on standardized dosing and predictable effects across cannabis formats remains a major challenge. A 2019 review highlighted this disconnect, noting the lack of evidence-based guidelines for cannabis formulation.

Fragmented regulations across states make standardization even harder, Emerson noted.

Proving What You Promise

Without robust research, the burden falls on brands to prove their products deliver promised effects-and on retailers to sell outcomes responsibly.

This is why evidence-based labeling and formulation data are becoming the next competitive differentiators in the industry.

The Future of Cannabis

The shift toward functional THC represents cannabis growing up. It's the industry moving from adolescent bragging about potency to mature focus on utility and reliability.

"The future of functional cannabis will depend on discipline-under-promise, over-deliver, and design products that are easy to titrate," Emerson advised.

For manufacturers, that means:

- Stronger R&D discipline

- Validated cannabinoid ratios

- Transparent data on outcomes

For retailers, it's about:

- Training teams to sell by effect

- Curating menus that reflect how people actually shop

- Educating consumers on functional benefits

A Bridge to Mainstream Acceptance

Perhaps most importantly, functional THC could expand cannabis beyond its traditional consumer base.

"Functional cannabis reaches people who never thought it was for them," Dolgin said. "When it feels like a safe, everyday alternative to things like sleep aids or painkillers, that's what brings wider acceptance-and legalization-closer."

In other words, making cannabis more like Tylenol than tequila might be exactly what the industry needs to achieve true mainstream acceptance.

About Marcus Chen

Culture Writer

Marcus explores the intersection of cannabis, art, and music. His work highlights the creative communities shaping the modern cannabis landscape.

Related Articles

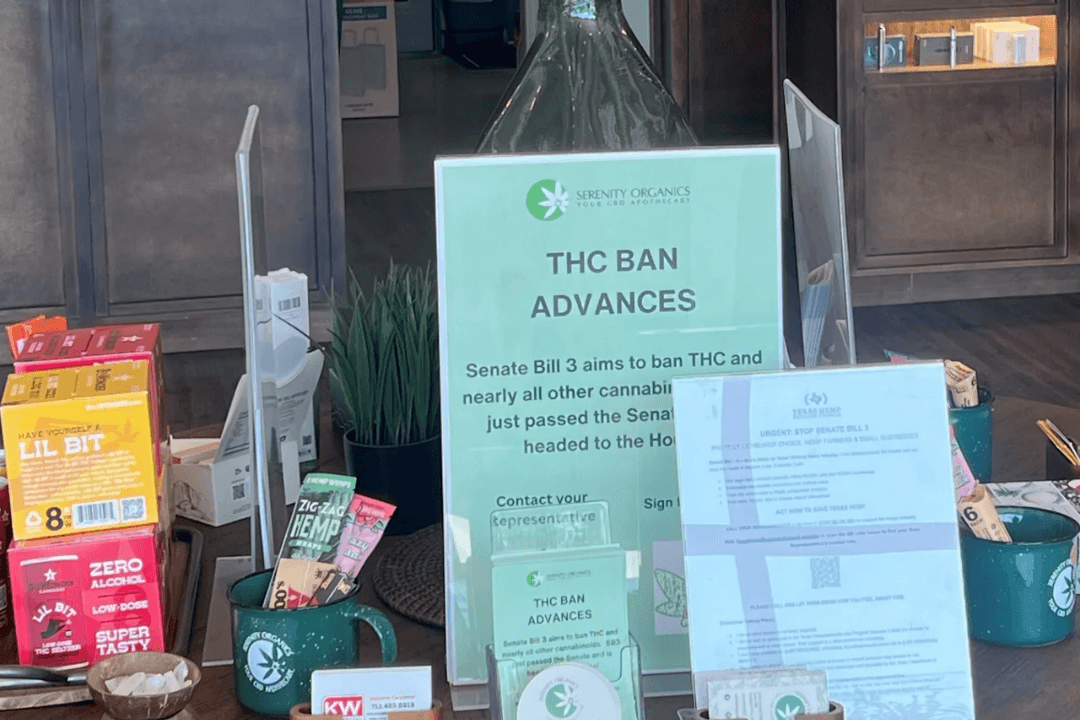

Ohio Charts Its Own Course on Hemp THC Beverages

While most hemp-derived THC products face prohibition in Ohio, the state is carving out a unique exception for beverages-at least through 2026.

Deception and Democracy: The Fight to End Cannabis in Massachusetts

A ballot initiative seeking to end Massachusetts' $1.6 billion cannabis industry faces accusations of using deceptive signature-gathering tactics-and there's little anyone can do about it.

Breaking Ground: Cannabis Medicine for Women's Health

Millions of women suffer from endometriosis with limited treatment options. Ananda Pharma is taking a pharmaceutical approach to developing the first regulator-approved CBD treatment for this painful condition.