The Fall of a Cannabis Giant: Cookies Faces Financial Collapse

How a $250 million cannabis empire found itself on the brink of insolvency

2025-11-23 · 5 min read

The cannabis industry has witnessed its share of dramatic rises and falls, but few stories are as striking as what's currently unfolding with Cookies, one of the sector's most recognizable brands.

From Forbes Cover to Financial Peril

Just three years ago, Cookies was riding high. The San Francisco-based cannabis branding powerhouse graced the cover of Forbes magazine in 2022, with the publication estimating its worth at a staggering $250 million. It marked a historic moment-the first time a cannabis entrepreneur had achieved such mainstream business recognition.

Today, the picture looks drastically different. A San Francisco judge's recent ruling has effectively cut off the company's primary revenue source, leaving the brand fighting for survival.

The Revenue Diversion That Changed Everything

The crisis stems from a November court order requiring Cookies to redirect its royalty payments to settle an $8.4 million judgment. These royalties-generated from Cookies-licensed stores across the United States, Canada, Israel, and Thailand-represent the lifeblood of the company's "asset-light" business model.

According to court filings from Cookies' legal team, this diversion leaves the company "without operating revenues," creating what they describe as an "immediate insolvency event."

What's at Stake

The court order targets several key Cookies assets:

- International and domestic licensing royalties

- The iconic Cookies Bus, a motorcoach associated with co-founder Gilbert Milam Jr.

- The "Adios" line of branded alcoholic beverages launched this past summer

The Partnership That Went Wrong

This financial crisis traces back to a licensing agreement Cookies signed with Cole Ashbury Group, operators of a San Francisco social equity cannabis store called Berner's on Haight. The deal, inked in 2019 during cannabis's more optimistic era, included a "put option" clause allowing Cole Ashbury to force Cookies to purchase the store for a flat $10 million.

When Cole Ashbury exercised this option in May 2023-well after cannabis valuations had plummeted from their early 2021 peak-Cookies found itself locked into a deal that no longer made financial sense. Attempts to challenge the agreement in arbitration proved unsuccessful.

The Vulnerability of Brand-Based Business Models

Cannabis attorney Chris Wood points out that Cookies' structure makes it particularly susceptible to this type of crisis. Unlike companies with substantial physical assets, Cookies built its empire primarily on brand licensing agreements.

"With Cookies, really, the only asset is the brand," Wood explained. The irony is that the very judgment threatening the company could diminish the brand's value, potentially giving licensing partners grounds to renegotiate or walk away from their agreements.

A Glimmer of Hope?

While Cookies faces this existential threat, the company is also pursuing a $24.3 million judgment of its own against TRP Co., another retail partner accused of failing to pay agreed-upon royalties. That award could theoretically satisfy Cookies' debt-if the company can collect it.

Both cases are currently under appeal, though legal experts suggest reversals are unlikely.

What This Means for the Cannabis Industry

The Cookies situation serves as a cautionary tale for the broader cannabis sector. It highlights the risks of asset-light business models in an industry still finding its footing, and demonstrates how quickly fortunes can change when market conditions shift.

As the industry continues to mature and consolidate, the fall of such a prominent brand raises important questions about sustainable business models, the importance of careful partnership agreements, and the ongoing challenges facing even the most successful cannabis companies.

For now, the cannabis world watches and waits to see whether this iconic brand can find a path forward-or if this marks the end of an era.

About Marcus Chen

Culture Writer

Marcus explores the intersection of cannabis, art, and music. His work highlights the creative communities shaping the modern cannabis landscape.

Related Articles

Cannabis vs. Whiskey: How Marijuana Is Reshaping the Spirits Industry

A craft spirits distillery is closing tasting rooms and restructuring its business model, citing the growing consumer shift toward marijuana as a key factor in the decision.

Delaware's Cannabis Zoning Dilemma: Progress or Political Theater?

After the governor vetoed legislation to override local zoning restrictions, Sussex County has amended its rules for cannabis businesses-but the changes may be too limited to make a real difference.

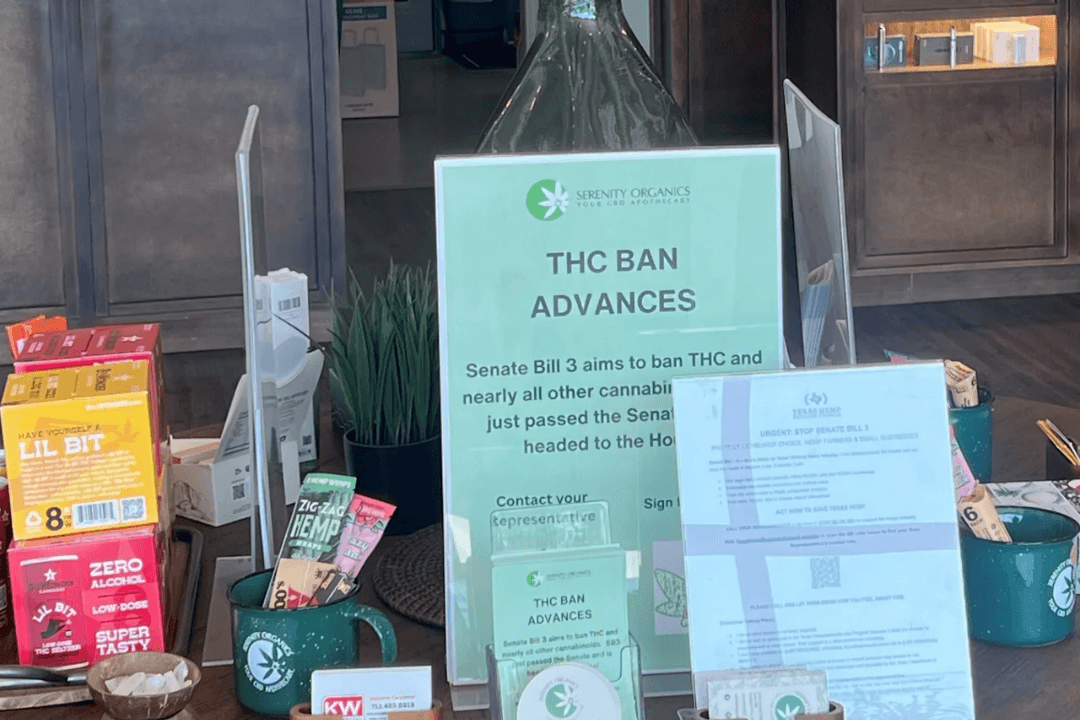

Ohio Charts Its Own Course on Hemp THC Beverages

While most hemp-derived THC products face prohibition in Ohio, the state is carving out a unique exception for beverages-at least through 2026.